Computer intelligence, or artificial intelligence (AI), is one of the most advanced fields in information technology today, based on machine learning. This innovation has encompassed all areas of human activity, including the currently extremely popular cryptocurrency industry. The introduction of artificial intelligence or the creation of smart tokens in the trading process is inevitable, but what consequences will this have for the cryptocurrency market?

This article discusses the relationship between cryptocurrency technology and artificial intelligence in the new stage of financial technology industry development. Additionally, you will learn how artificial intelligence will affect the cryptocurrency market and what factors hinder the full implementation of this technology. By the end of this article, the possibility of artificial intelligence changing the fundamental principles of the cryptocurrency industry will become clear.

Key Points AI technology will help improve the security of cryptocurrencies, optimize the cryptocurrency transaction process, and enhance the tools used for mining. The impact of artificial intelligence on the cryptocurrency market includes improving mining, enhancing blockchain security, developing smart contracts, and using market prediction tools. The symbiosis of artificial intelligence and blockchain will aim to improve technologies for detecting suspicious activities and preventing criminal activities in the cryptocurrency domain, among many other areas. Cryptocurrency and Artificial Intelligence—A New Stage in Fintech Development Blockchain and artificial intelligence are two of the hottest technological trends today. Although they are two distinct trends, researchers are actively discussing the benefits of combining these two technologies. PwC predicts that by 2030, artificial intelligence could add $15.7 trillion to the global economy, leading to a 14% increase in global GDP. Gartner forecasts that by the same year, the added business value from blockchain technology will rise to $3.1 trillion.

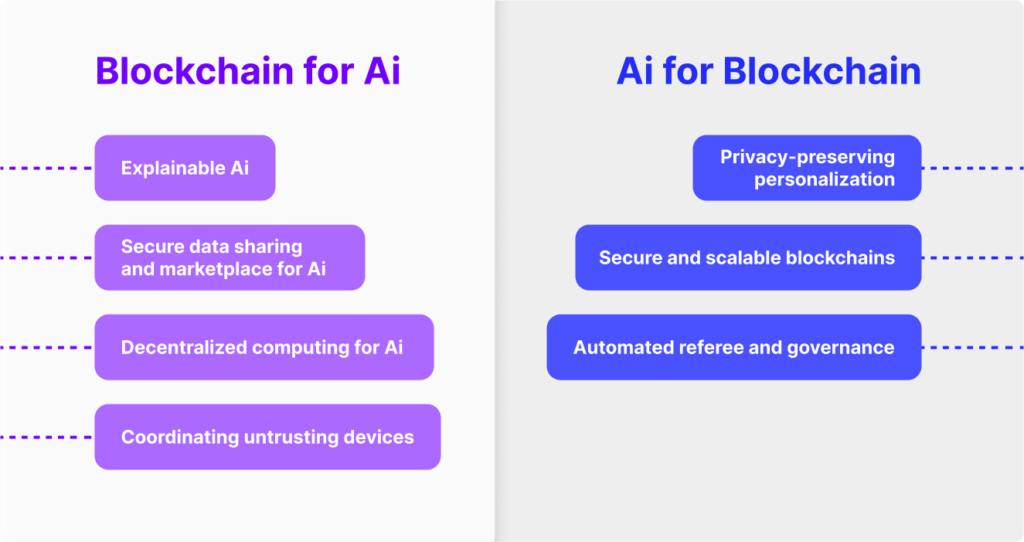

Both blockchain and artificial intelligence technologies have their own complexities, but artificial intelligence and blockchain are symbiotic technologies that can benefit from the union and help each other grow. Since these two technologies interact with data in different ways, combining them can take data usage to a new level. At the same time, integrating machine learning and artificial intelligence into blockchain can improve the architecture of underlying systems, significantly enhancing the efficiency of blockchain. Artificial intelligence solutions can overcome its limitations, for example, by making distributed ledgers more energy-efficient and secure. Machine learning will also help those institutions that adjust blockchains for specific tasks.

The application of artificial intelligence in cryptocurrency transactions is limitless. Besides automating trading and performing price predictions, this technology can be used for risk management and optimizing investors’ trading portfolios. Artificial intelligence systems can detect fraudulent schemes and are capable of monitoring market changes over the long term, potentially making them good risk management tools. Artificial intelligence algorithms can also optimize cryptocurrency portfolios based on specific investment goals and risk tolerance.

AI systems can be used to make optimal trading decisions or automate processes, such as price tracking and order execution. Moreover, artificial intelligence can improve the security of cryptocurrency transactions by identifying fraudulent schemes and verification processes. Thus, artificial intelligence algorithms can allow traders to enter and navigate relatively safely, encouraging an influx of traders and investors, increasing the market’s development potential.

With the introduction of artificial intelligence into the cryptocurrency domain, artificial intelligence cryptocurrencies, blockchain, and other machine learning-based cryptocurrency projects have started to emerge.

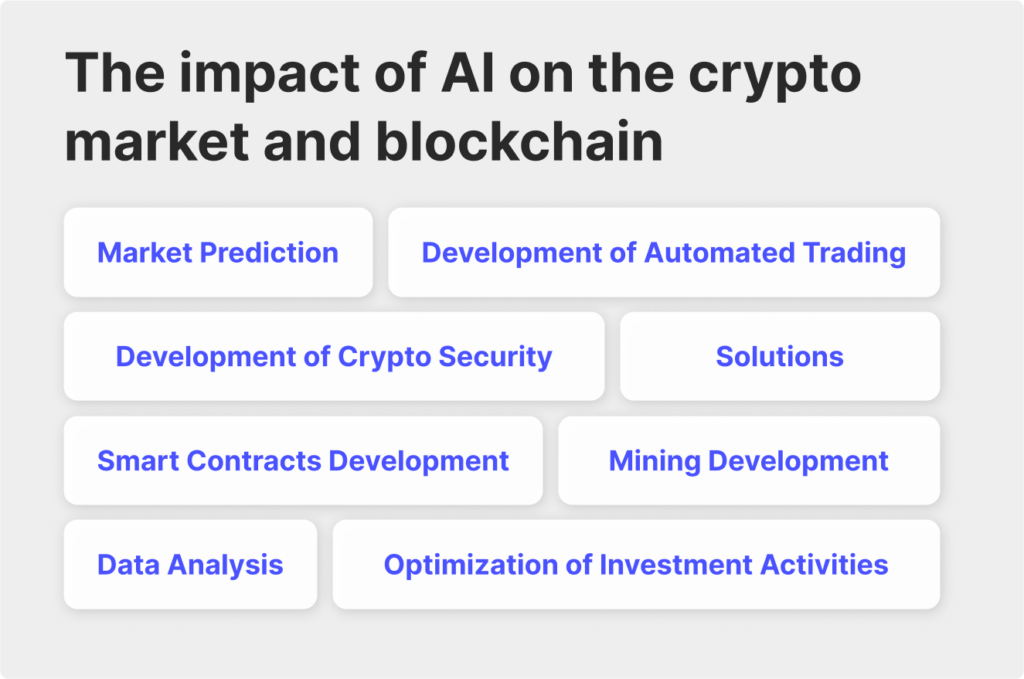

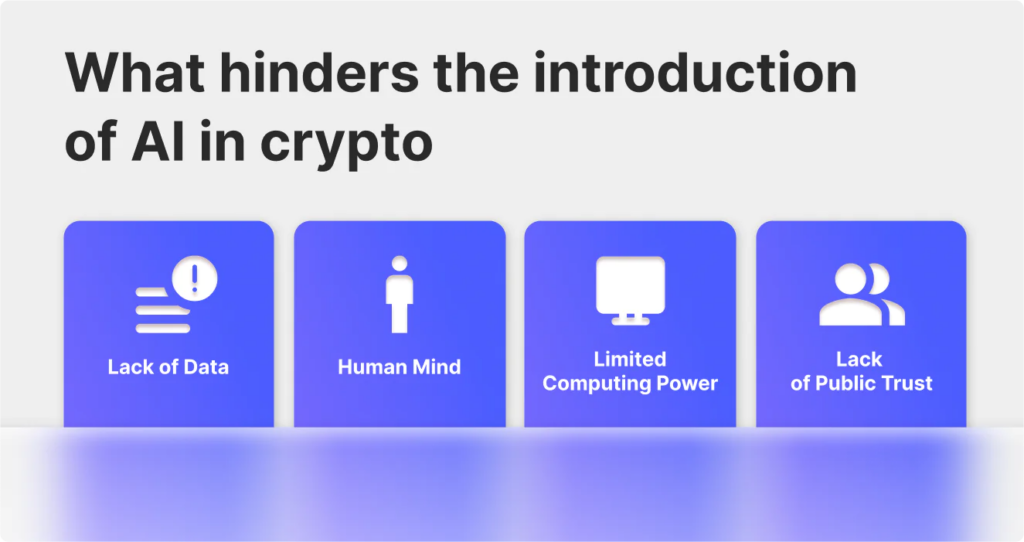

Quick Facts How Will Artificial Intelligence Affect the Cryptocurrency Market? Artificial intelligence in cryptocurrency technology will become the next big trend, as it has the potential to fundamentally change the way we conduct transactions, manage assets, and make investment decisions. With this technology, the use of cryptocurrency can be faster, safer, and more efficient for both individuals and businesses. Moreover, artificial intelligence can help reduce the risks of fraud, market manipulation, and human error, making cryptocurrency investments more reliable and trustworthy. Here is a list of the main challenges that artificial intelligence can address within the cryptocurrency industry once fully implemented.

Market Prediction Computational technologies based on artificial intelligence algorithms will make it possible to predict market trends and conduct comprehensive analyses of the data obtained, improving interaction mechanisms with financial market elements. At this stage, cryptocurrency investment, like any other type of investment, is based on technical and fundamental analysis, allowing for an approximate and superficial concept of market movement direction. Artificial intelligence will analyze vast amounts of information, such as news and forums, to predict the market trends of any cryptocurrency asset quickly and accurately.

Developing Automated Trading The introduction of AI technology in the cryptocurrency market will likely significantly improve algorithmic trading, undoubtedly increasing the profitability of such trading strategies. Currently, algorithmic trading is mainly developed using complex mathematical models, which are clearly inferior to artificial intelligence due to their imperfect working principles, based on ordinary human-written code. Artificial intelligence will eliminate this problem, allowing for the selection of the most balanced trading strategies for each risk level.

Developing Cryptocurrency Security Solutions The symbiosis of blockchain and artificial intelligence technologies will help combat various forms of cybercrime and fraud. By introducing machine learning algorithms to identify suspicious activities,